I know this is a short resource. Don’t worry, I got you.

You will still need some cash (or money in your bank account) for Out-Of-Pocket Expenses.

I explain all of those in a later step. This is just to get you started.

Option 1

If you have a traditional W2 job, this is pretty straightforward.

About 90% of employers use a Payroll Software System that connects to the TRUV system.

This allows most lenders to immediately have access to all of the information they need to process your application, with no further action necessary on your side!

Option 2

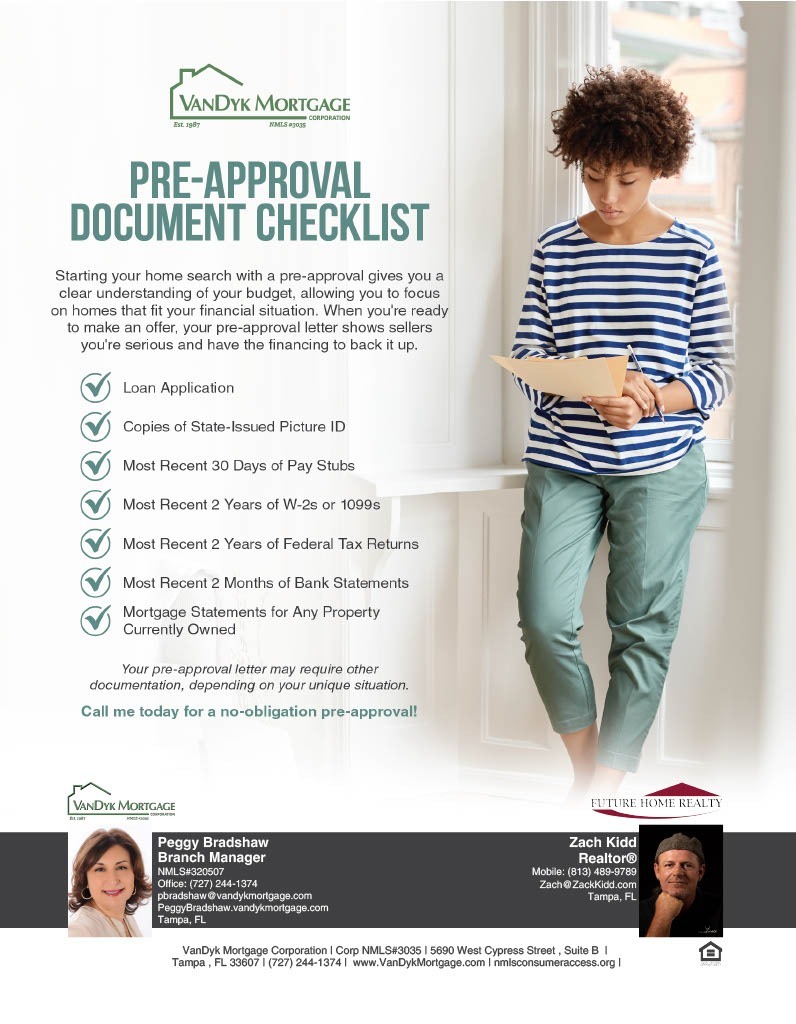

If your employer does NOT connect to the TRUV system, here are the basic documents you should have ready for your Lender.

Pro-Tip: You can and should upload these to the Portal for easy access!

(Opens in a new window)

* The Lender will provide the Loan Application to you

Option 3

If your employment is less conventional, don’t worry! The Lender will know what to ask for.

Be as forthcoming as possible. We aren’t here to judge your life – just your income and expenses.

In short, this will be a financial colonoscopy.

It will probably be uncomfortable, but it’s necessary.