It didn’t work out so great for Indiana Jones, did it?

That’s okay – I have several strategies to make it easier.

Also, there is zero chance of being chased by a rolling rock.

Table of Contents

BEFORE WE START…

Is there anyone in your friends or family circle that has a Real Estate License that needs to be included?

Like, will your Mom get mad that you didn’t include Aunt Sally?

If so, you need to talk to Mom & Aunt Sally before going any further.

Because those last-minute calls from Aunt Sally can really mess things up.

The Problem with Selling and Buying a House at the Same Time: Homeless, or Holding 2 Mortgages

Yes, I already have a ton of resources for you on the Seller’s Journey page and the Buyer’s Journey page. All of them apply, and there are links at the bottom of this page to get you there.

Before you check it out, we have some groundwork to cover.

Homeless?

Because if you don’t do this right, you’ll wind up homeless.

Seriously.

That’s your first consideration. If you Sell before you Buy, where are you going to live in the meantime?

Yes, you can rent. That brings it’s own set of problems. Four dogs, first, last, security deposit, 6 month minimum lease, etc.

And you have to move.

Twice.

Holding?

On the other hand, if you Buy before you Sell, you could be paying two mortgages.

For a while.

And that adds up quickly, especially if you’re moving up to a more expensive home.

Hopeless?

Neither are good options. Depending on your financial situation, one may be the lesser evil and you can deal with it.

But if money is a bit tighter, it gets scary pretty quickly.

There is hope, though.

Step 1: Know the Market

Balanced Market

Generally speaking, somewhere around 5 or 6 months is considered “Balanced”.

Just the right number of both Buyers and Sellers.

And prices kind of stay the same.

Lowball offers may or may not be tolerated.

(I’m partial to the 6 month marker, but it’s debatable.)

Sellers Market:

If homes are selling quickly and there is a lot of competition, then that’s considered a Seller’s Market (or “Sellers Market” – no apostrophe).

There are plenty of Buyers, and few Sellers.

Home Prices go

UP during these periods.

Lowball offers are laughed at…and immediately forgotten about.

See: 2020’s feeding frenzy.

Buyers Market:

If homes take more than 6 months to sell, then it’s a Buyer’s Market (or “Buyers Market” – no apostrophe).

There are plenty of Sellers and few Buyers.

Home Prices trend

DOWN during these periods.

Lowball offers may be considered.

See 2010 when people couldn’t give a home away for free.

How to Know the Market?

Ask your Real Estate Agent (not Google or Zillow or Aunt Edna) what the Inventory Period and List to Sale Period is like right now.

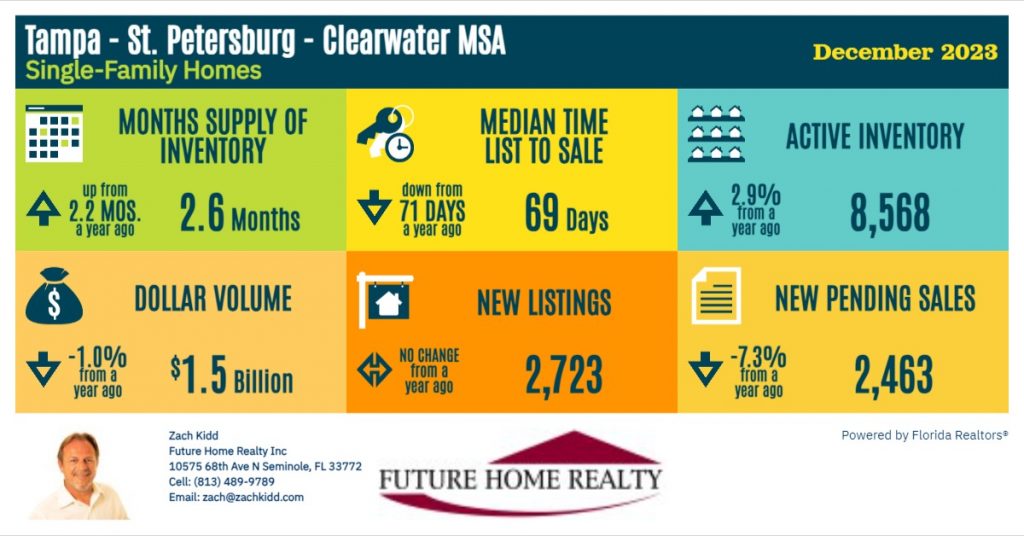

In this infographic, that’s Months Supply of Inventory on the top left corner, and the Median Time List to Sale in the top-middle section.

Months Supply of Inventory?

Yes, it a funny sounding term, but Months Supply of Inventory says that, if absolutely no one Listed their home for sale, the market would run out of homes (in this example) in just 2.6 months.

Roughly 78 days.

That’s pretty fast.

Median Time List to Sale?

Also somewhat awkwardly named. Let me break it down so it makes more sense.

Median Time

… just means the middle average, but not counting the extreme outliers.

If Aunt Edna overpriced her home and it sat on the market for 3 years before someone bought it, it’s not counted in the statistics.

Likewise, if she sold it to a family member and it didn’t even get a day on the market, it’s not counted either.

List to Sale

From the day a post and sign went in the front yard, to exchanging checks and keys at the closing table, most homes went completely through the entire sales process in just 69 days.

For those of you who aren’t math wizards (I’m not – but I have a calculator in my pocket!), that’s less than half of the 6 months for a Balanced Market.

Closer to one-third of the time.

So it’s still a pretty hot Sellers Market!

Why does any of this matter?

These aren’t the only metrics, but I think they are the most relevant to this conversation.

You have to match your Strategy to the Market Conditions.

In fishing parlance, you need to “Match The Hatch”.

What are the fish eating? Feed them that and you’ll catch a fish.

Step 2: Know your home’s value

That part is easy because you came to the right place!

Introducing: Homebot

Put in your address, then if you want to, an approximate amount left on your mortgage. That’s it!

Homebot tracks the market value in your neighborhood via recent sales.

And it automatically updates your home value and Equity.

You can get those updates via email, or via the app.

Don’t worry – your information is not sold to a third party. You won’t have telemarketers bugging you.

Just me, every once in a great while. And I’m a pretty chill guy.

You can get the mobile apps here:

If you’re in the mood to shop for your next home, you can start shopping here too:

Step 3: Take Action

Actionable Examples

For example, in a Sellers Market, it’s pretty easy to Sell your home.

But it’s far more difficult to Buy a home.

So, prepare your home for sale, get all of the pieces lined up, ready to go.

Then get your Loan Pre-Approval from your favorite Lender.

Depending on your Real Estate Agent, they may or may not take you shopping while waiting for your Pre-Approval.

But get out shopping as soon as you can.

Pro-Tip: You don’t need an agent to hit Open Houses on the weekend! You may even find a great agent at one.

Go find your next home, or something really close.

Figure out:

- What you need

- What you want

- What you like

- What you despise

The second that Pre-Approval comes in, go do battle to get a contract accepted on the next home that ticks all of your boxes.

When you get it Under Contract (Pending Sale), send in the Home Inspector.

If that report comes back clean (or clean enough), then post that sign in your front yard!

You will minimize the time between Buying your next home, and Selling your current one. It could even be a matter of hours!

Contingency Sale

There is an additional form that can be included in the offer: CR-6_V. Sale Of Buyers Property .

This is called a Contingency, and basically says you will complete the Purchase as soon as the Sale of your home is finalized.

If the market is really hot, it could weaken your offer in the eyes of the Seller (and their Agent).

But it’s a much safer bet.

Only you can decide if the reward is worth the risk.

Bridge Loans

These loans Bridge the gap between buying and selling. That’s Lender territory, but it could be a great solution for you.

Other Strategies

There are plenty of tools in the toolbox to make this a successful scenario for you.

These revolve around more in-depth discussions particularly suited to your needs and desires, but…

They aren’t worth going into detail here.

But what about the other way around?

We haven’t had a solid Buyers Market in a decade.

But the principle is similar, if reversed.

You’ll want to put your current home up for sale immediately, and shop at your leisure.

But you will need to have a back up plan. And that’s probably going to involve a rental.

If someone loves your home and wants to buy it Month One, what are you going to do?

If the price is right, then yeah, you should probably take the deal.

So you’ll need to shop for a rental every month and have at least a couple of solid options lined up just in case.

It is less than ideal, but you won’t be homeless.

GET STARTED

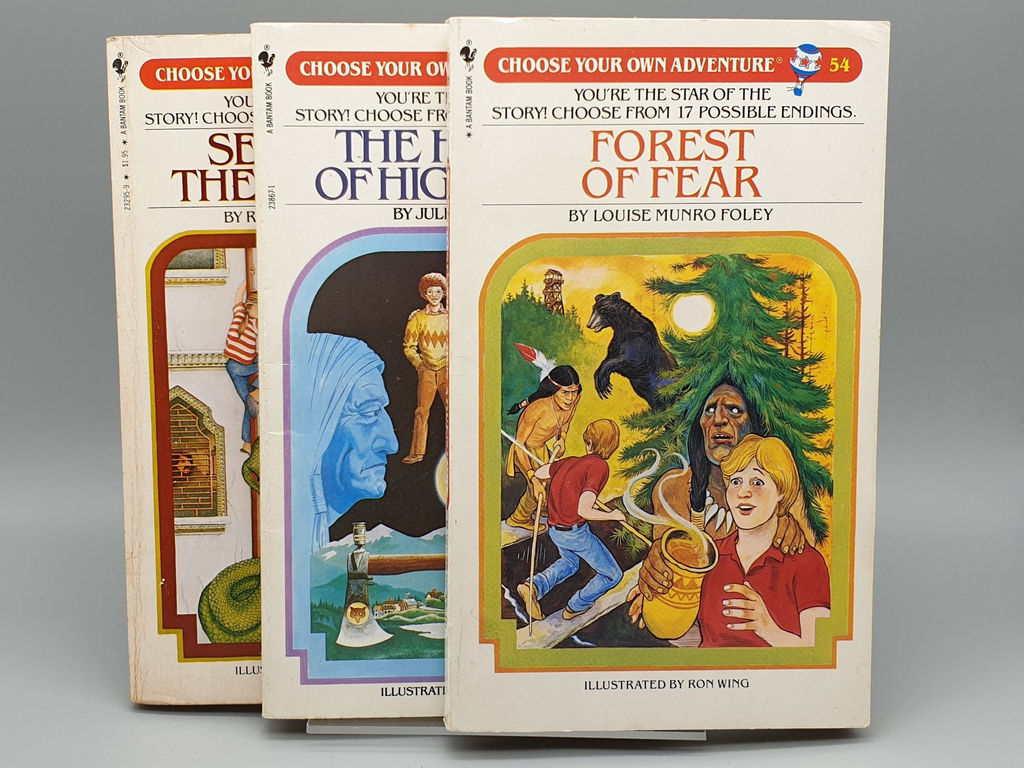

It’s time to Choose Your Own Adventure.

Will you Sell first, and then Buy?

Or will you Buy first, and then Sell?